Electrification and ESG: Shaping the Future of Sydney CBD Offices

Electrified, net zero-ready office buildings are defining Sydney CBD’s next growth cycle driving higher demand, ESG value, and leasing success.

As Sydney’s commercial real estate market enters a new cycle of growth and selectivity, electrification and operational net zero readiness are emerging as defining forces for office assets in the CBD.

Electrified office space refers to a commercial building that operates without on-site fossil fuels, such as gas for heating, cooking, or water systems. Instead, it uses all-electric solutions, typically including heat pumps, electric water heating, and smart energy controls, often paired with renewable energy sources and EV charging infrastructure.

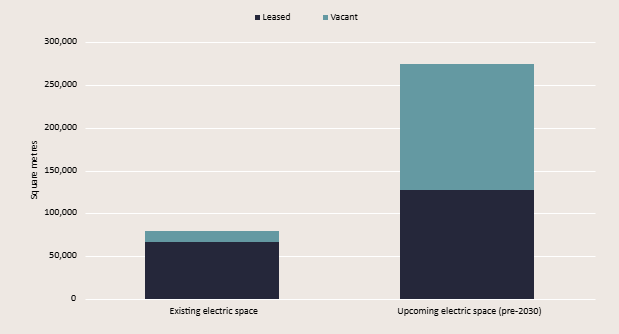

Estimated leasing take-up on existing electric assets versus upcoming electric assets

Premium office assets in Sydney CBD, in square metres,

Source: Savills

Chris Rowe, State Head of NSW Office Leasing at Savills Australia observes, “We’re seeing a clear shift in tenant expectations—demand for electrified, net zero-ready office space is accelerating as occupiers prioritise sustainability and seek to future-proof their operations.

For landlords, this is a pivotal moment to invest in decarbonisation and position assets for long-term relevance.”

Leading the transition are financial services, technology, and life sciences firms, with recent ACSI research showing that 94% of ASX50 companies and 66% of ASX200 companies have now set net zero commitments. Sydney’s CBD already features two premium, fully electrified office assets—Parkline Place and 39 Martin Place—completed in 2024 and offering a combined 80,000 sqm of electric net lettable area.

Looking ahead, an additional 275,000 sqm of electrified office space is in the pipeline, including Harbourside on Sydney’s Darling Harbour waterfront—a flagship project set to deliver in two stages through to 2027. Other major developments include Chifley South and Atlassian Central, all scheduled for completion before 2030.

“For landlords, investing in electrification and energy efficiency is no longer optional—it’s essential for attracting and retaining quality tenants. We’re seeing that buildings with strong ESG credentials are achieving higher occupancy rates and rental premiums, while older, non-compliant assets risk being left behind,” notes Rowe.

Lauren Williams, National ESG Manager at Savills Australia, adds, “Electrification isn’t just about compliance—it’s a catalyst for broader ESG impact. By transitioning to all-electric buildings and integrating renewable energy, landlords can significantly reduce operational emissions, improve building performance, and enhance the overall health and wellbeing of occupants. These benefits are increasingly valued by both tenants and investors, and position assets for long-term resilience.”

Williams continues, “ESG is also moving from a reputational consideration to a regulatory obligation. Mandatory climate-related reporting will be phased in over the coming years, initially targeting the largest companies and progressively extending to more businesses. This is driving greater collaboration between owners and tenants, as both parties face increasing reporting requirements.”

Beyond compliance, ESG practices are enhancing investment performance—supporting stronger asset values and rental growth for premium office assets. “Sustainability upgrades, even partial, are now critical for tenant retention and investor demand. Buildings that deliver improved energy efficiency, reduced emissions, and compliance upgrades are better insulated against obsolescence and will command a premium as market selectivity rises,” Rowe explains.

As electrification and operational net zero readiness becomes central to office strategy, Sydney’s CBD is poised to lead Australia’s transition to a low-carbon, high-performance commercial property market—offering landlords a clear pathway to future-proof their assets and maximise leasing success.

Further reading:

Showcasing Asia Pacific sustainable buildings

Contact us:

Chris Rowe