Japan hospitality enters new territory

Japan tourism is booming with record visitors, regional hospitality growth, strong hotel investment, and rising ADR & RevPAR driving new opportunities nationwide.

Japanese tourism continues to boom, with both visitors and investors taking interest in areas outside the nation’s most popular tourist destinations.

Inbound visits are set to hit 40 million this year, after reaching 21.5 million in the six months to June. This would be a second record year for Japan tourism, after receiving 36.87 million visitors in 2024, nearly 20% above its pre-covid high.

While there have been some concerns about overtourism in cities such as Tokyo, Osaka and Kyoto, there are signs that the market is diversifying into new areas.

“The pent-up demand which led to overtourism in major cities is gradually spilling over to regional cities, especially among repeat visitors seeking for more authentic cultural experiences, which should bode well for the broader growth in Japan’s hospitality sector” says Tetsuya Kaneko, Managing Director, Head of Research & Consultancy, Japan at Savills.

Areas coming into focus include Kanazawa, which has been growing in popularity since being added to the shinkansen network. Singapore-listed CapitaLand Ascott Trust recently acquired the 392-guestroom Budget Kanazawa Ekimae for ¥5 billion.

In Hokkaido, where Niseko has been a long-standing skiing destination, hotel developers are targeting alternative locations. German hospitality company TUI is teaming up with Japanese real estate company Nihon Shintatsu. Japanese developer Sekisui House is planning to construct a luxury Westin hotel in Furano, Hokkaido.

Meanwhile, the southern island of Okinawa has welcomed a new nature park, Junglia Okinawa, which is expected to boost visitor numbers and investor interest in the region.

Investor interest in hotels remains strong, with overseas players and domestic real estate investment trusts (REITs) active. Kasumigaseki Hotel REIT was listed on the Tokyo Stock Exchange in August, the first J-REIT to be listed since 2021.

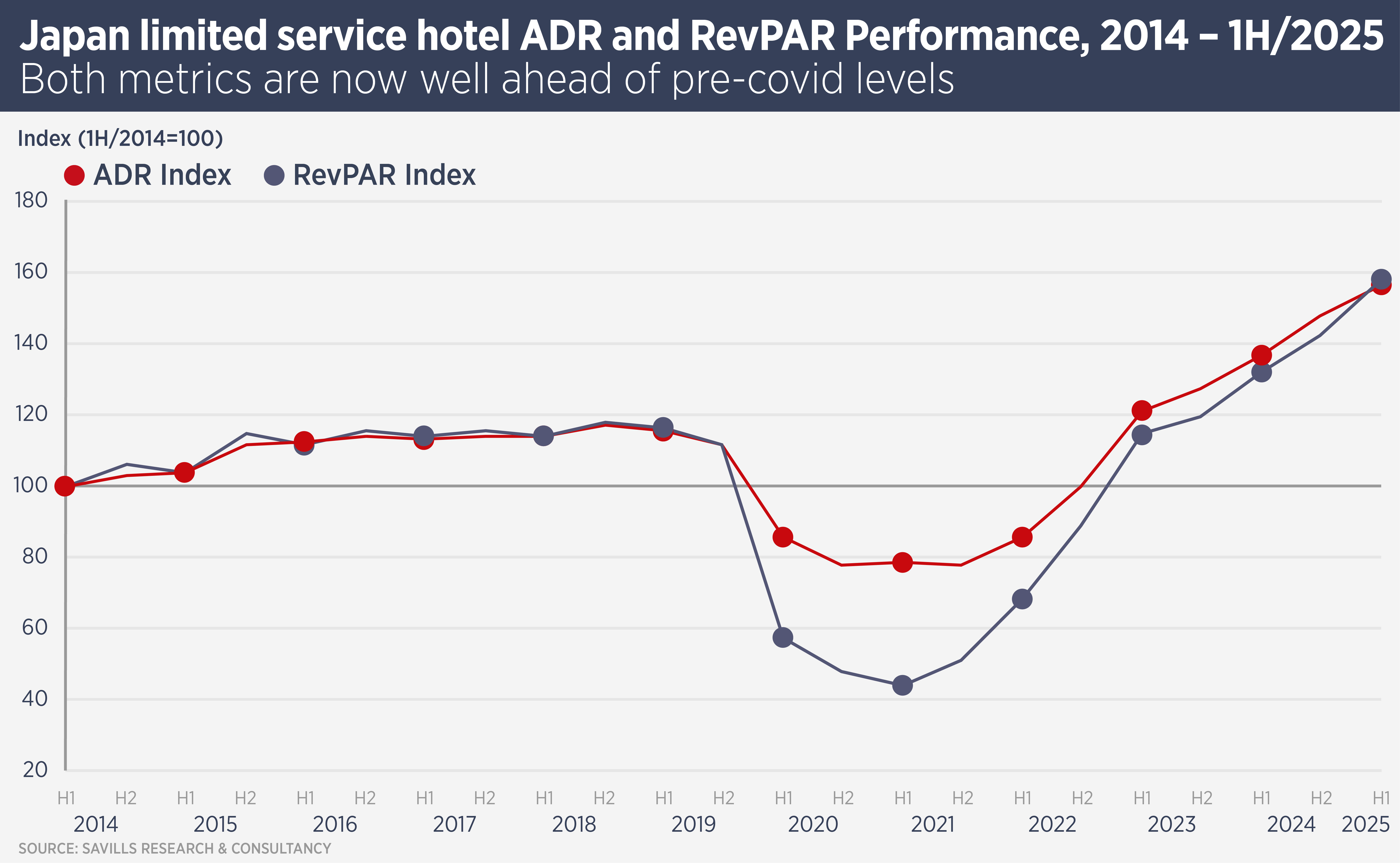

The investment thesis has been supported by strong hotel performance. Savills tracks the performance of more 100 hotels owned by J-REITs, finding that both average daily rates (ADR) and revenue per available room (RevPAR) rose more than 20% in the year to June. Both these key hospitality metrics are at record levels.

Japan is also working to address some of the challenges to hospitality market growth, the most serious of which is a shortage of labour. However, hotel groups are using technology to reduce staffing numbers and the government has been ramping up efforts to welcome foreign labour.

The nation looks on track to hit the government target of 60 million visitors by 2030. Tapping into the potential of less well-known areas will be an important part of this.

Kaneko says: ” With strong local government support and innovative efforts to attract more tourists underway, there are still ample opportunities, pointing to promising growth prospects for the hotel sector in regional markets.”

Further reading:

Japan Hospitality – August 2025

Contact us:

Tetsuya Kaneko