Asia Pacific senior housing offers a golden opportunity

Discover senior housing investment opportunities across Asia Pacific, as aging populations and rising wealth drive demand in Japan, Australia, and India.

A combination of aging populations and rising wealth make senior housing in the Asia Pacific region an attractive investment, even in developing markets.

Today, approximately 16% of the Asia Pacific population is 65 or over, according to UN data, but this is project to rise to 30% by 2050, meaning the total number of elderly will rise to more than 1.5 billion. The cause is falling birth rates and longer life expectancies.

“Changing demographics means not just more older people, but fewer descendants to care for them,” says Simon Smith, Regional Head, Research & Consultancy, at Savills Asia Pacific. “This creates a need for specialist accommodation which meets the needs of older people.”

Senior living covers a broad range of property types, from homes simply targeting an older demographic to nursing care. “Furthermore, the demand for senior housing is changing,” says Smith. “People are staying healthy and active for longer, so wellbeing, activity and community may be more important than care.”

Below, we take a look at three very different Asia Pacific markets and the potential for real estate investors to meet the needs of older people in each.

Japan

With close to a third of its population over 65, Japan is the world’s ‘oldest’ nation and naturally has a fairly developed senior housing market, with a range of product types depending on the level of care required. Additionally, the government seeks to support aging in place where possible.

However, Japan is challenged by the expected rise in the number of elderly people living alone and elderly couples without family support. Furthermore, there is a shortage of care home places, with 400,000 people waiting for public nursing homes. Japan also suffers from a lack of care home staff, which has led to research into robot and AI care.

Real estate investors have recognised the demand in Japan, which is already the preferred market for cross-border investors in Asia Pacific. US investment manager Nuveen invests in senior housing through its Japan Alternatives Living Fund, while the Japan Senior Living Investment Corporation is a real estate investment trust focusing on the sector.

Australia

The combination of rising property prices and a robust superannuation programme means Australia has some of the region’s most prosperous retirees and a number of real estate investors have created developments to suit them. Retirement villages operated by companies such as Keyton (Keyton village in Rowville, Melbourne pictured abvove) and Aveo Group offer downsizers homes with a range of facilities and services.

The sector continues to attract investor interest. Earlier this year, student housing company Scape, in partnership with South Korea’s National Pensions Service, bought Aveo from Brookfield Group for A$3.85 billion ($2.56 billion), demonstrating the depth of domestic and overseas interest in the sector.

India

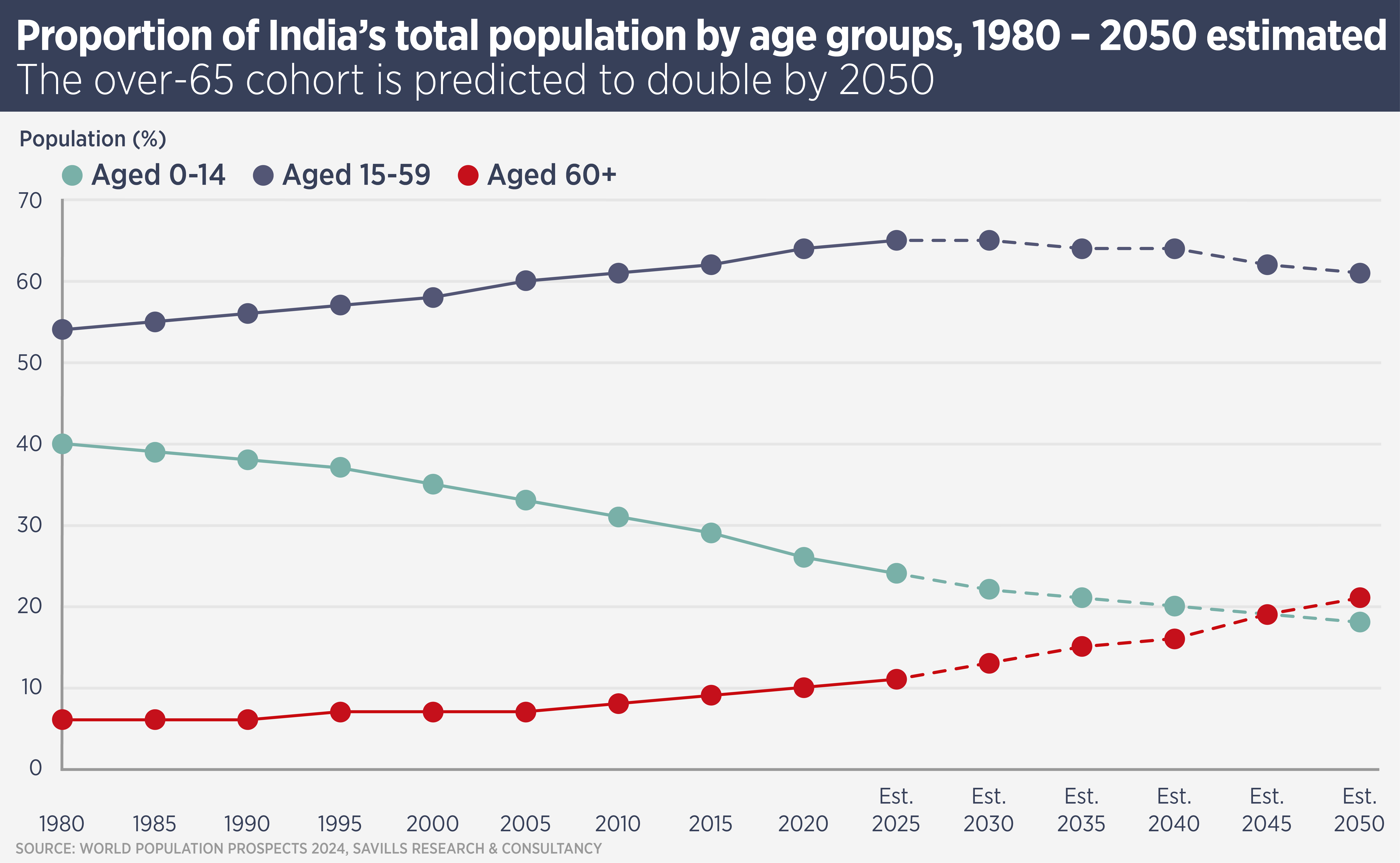

Despite having one of the more youthful demographics in Asia Pacific – the median age in India is only 28.4, 20 years younger than in Japan – senior living is expected to be a growth area. The proportion of over-60s in the population is set to double by 2050, which means India will have more than 300 million older people, a substantial market.

A Savills India Research report is one of the first to examine the potential for this sector. Arvind Nandan, Managing Director, Research & Consulting, says: “This is an opportunity to shape not just physical spaces, but the very experience of growing older in India.”

Previously confined to the realm of charitable old age homes, senior living in India is now evolving into a dynamic model which offers comfort, healthcare, and community to increasingly discerning residents. At present, most senior housing is in the form of independent living facilities, but there is a growing number of assisted living facilities offering greater levels of care.

There is a growing number of specialist operators, including Antara, Ashiana Housing, Columbia Pacific, Primus and Vedanta Senior Living, but the market is still small. Savills estimates Indian senior living requires $4.8-8.4 billion of investment between now and 2030.

Further reading:

Senior Living India report

Contact us:

Simon Smith