The best and the rest

Discover how premium office spaces in Asia Pacific outperform with high demand for sustainable, well-connected workplaces driving tenant and investor interest.

Premium office space is outperforming in Asia Pacific markets, as tenants and investors prefer modern and sustainable space in the best locations.

Office markets around the Asia Pacific region are performing very differently, from Hong Kong’s battling oversupply to Seoul, where vacancy is at a 10 year low, however a common factor is the outperformance of prime assets, especially in recovering markets.

Simon Smith, Regional Head, Research & Consultancy, Asia Pacific at Savills, says: “Major office occupiers are looking for the best possible space to help them attract and retain staff. In markets where employers are trying to encourage staff back into the office, this is even more important. They are looking for amenity, connectivity and sustainability, all essential characteristics for the best office assets.

“In cities where vacancy is elevated or the market is recovering, occupiers are also taking advantage of lower rents and securing upgraded space in a flight to quality. Meanwhile, those assets which attract tenants will naturally attract investors.”

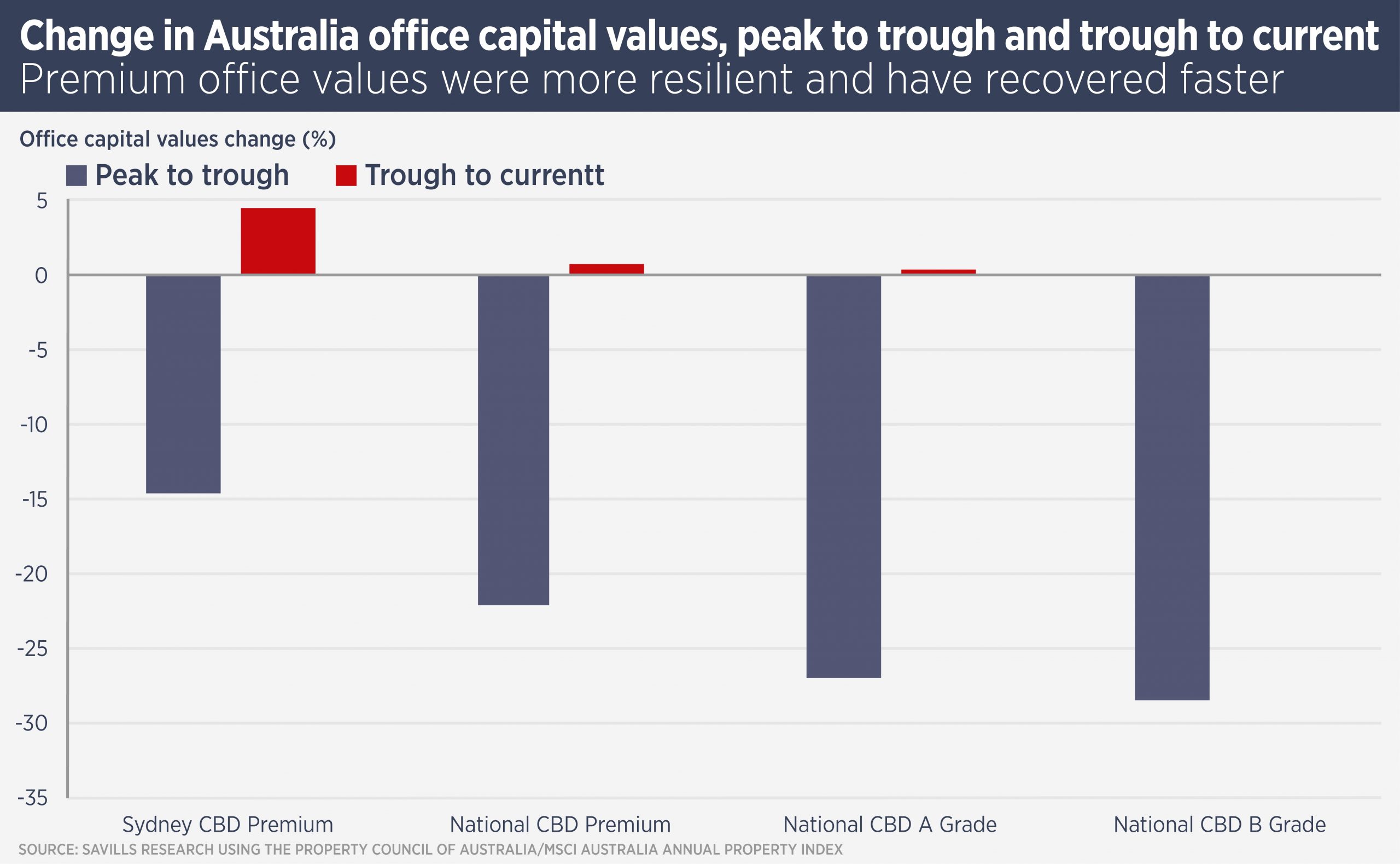

In Australian office markets, for example, capital values have begun to recover in Premium and Grade A space, with stronger performance in Premium offices, particularly those in Sydney. Meanwhile Grade B values continue to languish more than 25% below their cyclical peak.

Property Council of Australia data show the spread between Premium and A Grade vacancy continues to widen. Nationally, the A Grade CBD office vacancy rate sits at 15.2%, 3.7 percentage points above the Premium Grade equivalent of 11.5%, the highest spread since January 2022. Sydney and Perth have particularly large spreads between Premium and A Grade vacancy at 7.7 and 7.6 percentage points, respectively.

In Hong Kong, the beleaguered office market has seen an uptick in hedge funds taking space in prime office buildings such as IFC, AIA Central and Chater House. This has supported higher rents in these and other prime assets.

Vacancy rates remain high across Chinese cities, exceeding 20% even in first-tier markets, with rents having declined for three consecutive years and demand still weak. Despite fierce domestic competition, Shanghai’s scale still attracts consumer and retail companies. Tenant-favourable conditions are allowing occupiers to upgrade to better quality or downtown space at affordable rates, with best-in-class developments maintaining lower vacancy levels.

Meanwhile, in Tokyo, where the office market has recovered strongly since the pandemic, the gap between Grade A and Grade B space has been more consistent over time and vacancy is low in both the Grade A and B sectors. Nonetheless, in the second quarter of this year, Grade A offices in Tokyo’s Central Five Wards rose 8.3% year on year, compared with 6.8% in Grade B space.

Smith says: “In markets with elevated vacancy, we expect occupiers will seek to upgrade their space.”

Further reading:

Australia Office Briefing

Contact us:

Simon Smith